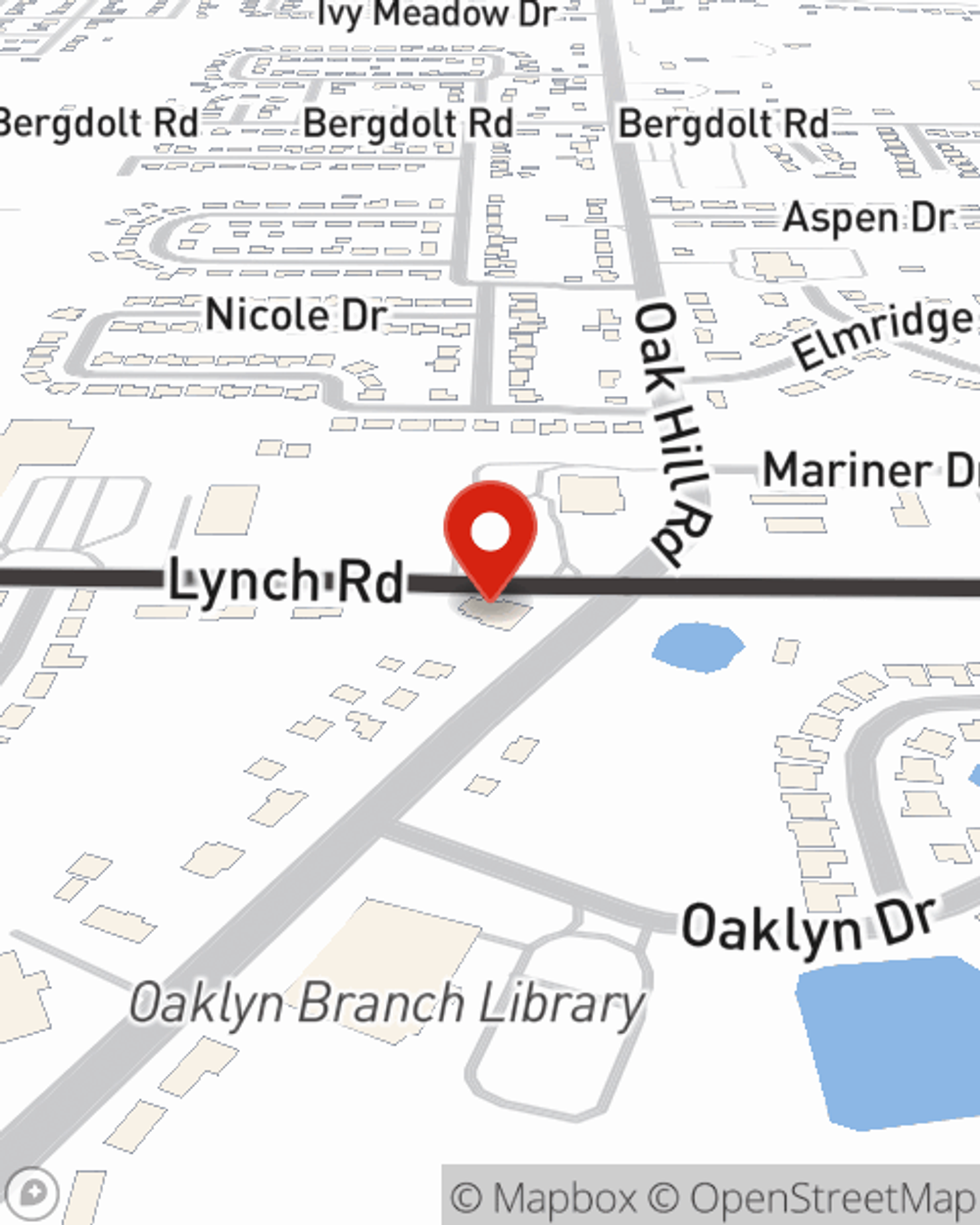

Business Insurance in and around Evansville

Searching for insurance for your business? Look no further than State Farm agent Jenna Powers!

No funny business here

Insure The Business You've Built.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, worker's compensation for your employees and errors and omissions liability, you can feel comfortable that your small business is properly protected.

Searching for insurance for your business? Look no further than State Farm agent Jenna Powers!

No funny business here

Small Business Insurance You Can Count On

Whether you own a barber shop, a dry cleaner or a clock shop, State Farm has you covered. Aside from great service all around, you can customize a policy to fit your business's specific needs. It's no wonder that other business owners have rated this as one of their top choices for business insurance.

Call Jenna Powers today, and let's get down to business.

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Jenna Powers

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.